|

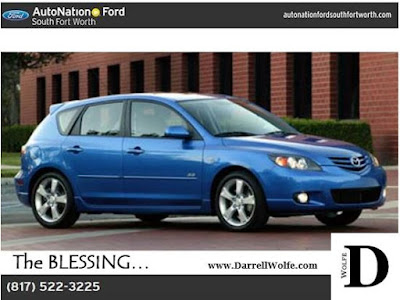

| 2005 Mazda3 - Special Thanks to AutonNation So FW |

I wrote in detail about the two weeks that brought me to buying a new car, and how I came to that decision, on my personal blog here.

Disclaimer:

I don't believe that there is one perfect choice of what kind of car, or even where to buy one. Recently, I was telling my 10 year old son that I heard people complain about the car they had bought, and how it wasn't working right, and "Why should they pay for a car that they can't drive?".

My 10 year old son says: "They took a loan, they should pay for it. Why didn't they pray before they bought it? Slow down, pray, and hear from God so you buy the car people!". Wisdom of Children.

My opinion is that before you make any decision you should pray, hear from God, and follow His lead. But I will attempt to break down the options on the "where" question for you here.

Side Note: NADA has some interesting statistics on the car industry (here), and TIADA (here).

Private Party VS Dealership Buying

Are you a mechanic, or steeped in that knowledge? We've had very little success buying private party. Usually if someone is trying to sell their car private party, it's because it was too trashed to trade in. But that's not to say it's a bad idea, or always true. You could find that someone has a great car, but they know they can get a better deal selling it private party instead of trading it in. That will give them more cash to put down on the new car.

If you know what you are looking for, or you are very spirit led, you might get a great deal from someone private party.

Bill of Sale

If you do, you'll want to print a Bill of Sale. This helps establish what you will and won't be agreeing to, and what the other party is agreeing to as well. You can find Microsoft Word templates by opening a new Word Doc, and searching Bill of Sale. There is wording all over Google to help you. Also, the DMV.Org Website has an option to fill out a form to print (here). NOLO also has a form (here).

I've written a whole page of instructions on how to deal with the registration and title transfer; instructions HERE.

The Small Dealership

It seems like, in Texas, you can put three cars on your front yard and call yourself "a dealership". It's amazing how many dealerships there are here. No seriously... I bought my last minivan from a guy whose "dealership" was at his house. His Covered Porch was his office. His "lot" was 10 cars on his front yard. Weird....

It seems like most of them are run by three guys with nothing better to do, and 20 cars that may or may not run. We've had good and bad experiences with these. Unfortunately, just like private party, you should either know what you are looking for, or be very spirit led.

On the upside they are CHEAP. You can buy a car for $500, $1,500, $3,000.... etc.

BUT....

These cars will not have been through a 126 point inspection. They make no claim to the unit's reliability. Either they got it in on trade, or they got it from a car auction. The car I traded in this month (that needed a LOT of work) will go to just such an auction, to get picked up by one of these types of dealerships. Hopefully, they put some work into repairing it, and make it worth buying again.

We've bought a few cars from places like this, but they usually don't last that long. However, they did get us by.

After I added it up, from 2009-2015, I've spent (price + repairs) $13,000 on used cars. All of which died within 1-2 years. Sure, I had no monthly payments, I just put a huge chunk down every Tax Return. But I was constantly dealing with issues all year.

I failed my Dave Ramsey Plan. I should have been paying myself every month, so I could buy a nicer and nicer car each time. Like making a car payment in reverse. I didn't. And now my only car died.

I'm over it. I want a newer car. I'm not ready for NEW, but I want something that runs. So we went out to buy a car.

The Usual Traditional Car Dealership

We visited Shall Remain Nameless (unless you click here or here), and experienced the hustle of a Traditional Car Dealership.

Uhg!

There are no prices listed on the cars. I ask about the price and I hear, "I'm not sure, I'll have to check" (but makes no move to go check). I told him that we wanted to end up at $7,000 (total sale price), they showed us two that "might work for us". While continuously evading my price questions.

We sit, we spend hours, test driving, sitting, waiting, they bring us paperwork with a sale price DOUBLE ($14,500+) what I told them the first moment I talked to them. I thought they had "two that might work for us"?

Well... They wanted to talk about payments, and get us to forget about total price. You see, if they can get me to agree to $150/Month ( my original target was $130/Month), than who cars about the total price, right? Wrong. Total price matters. I can pay off a $7,000 car twice (or more) as fast as a $14,000 car. Period. Price Matters.

How can this type of business practice still be legal? In the connection economy, it's thankfully dying away (just wish it was gone completely).

In 2005, I bought a car from a place like this, it was repossessed in 2007. Never again.

Thankfully, we had the presence of mind to leave.

The Better Choice

New Era Dealers like CarMax and AutoNation are built on the understanding that the Connection Economy will not allow for the old Car Dealership type of treatment any longer.

The prices are, generally, non negotiable. Why? They advertise a price that is as low as they can accept, and is still fair for them. They only sell vehicles that have passed their inspection. They just make the process as painless as possible.

You should still be spirit led, you can buy a car that looks good (even to a mechanic) that breaks down because of something you couldn't have known. However, this is the best experience I've had when car buying in my life.

AutoNation had a few vehicles that were targeted to lower prices than CarMax, so check out both. This just means that AutoNation carries cars that are a little older or higher millage; but, still pass the 126 point inspection.

This month, I went to AutoNation South Fort Worth, on I-20. The process was painless. No hustle. No haggle. Doug B and Doug W with AutoNation SFW were great to work with, patient with my questions, gave me time to digest figures and run my excel sheets.

In the end, we left with the car that had shown up over, and over, and over, in our search (spirit led). The one I kept getting drawn to, but couldn't quite explain why. The one I kept ignoring, looking for other things to satisfy my reasoning and mind.

No, it wasn't in line with my 150 item list of "must haves", but it was the right fit. Then again, there exactly ZERO cars that fit that list.

Funny Side Note: I kept looking for a car with 40,000 miles. The Monday after I made this purchase, I heard a guy complain to that the car he bought at 40,000 miles kept breaking down. Praise God for being Spirit Led.

Financing:

Hopefully, you've been on the Dave Ramsey plan long enough not to finance. But, if your not, then here are some options.

There are a lot of ways to finance.

If you have a bank, apply with them first. Do it online, because then the decision (with score) will come to you online. Even if it's declined, you'll get an idea of what your score looked like.

If you are blessed enough to bank with USAA Bank, I highly recommend you START there, and if approved, go no further. The process is painless, and their customer service is second to NONE. They are patient with your questions. The only caveat I have for you: Don't print the loan docs until you are sure you have decided on the car. It's just easier that way, because you can edit your choices.

If you let the dealership do it, that can be good ( they can often search up to 40 lenders at once). They will run your credit through multiple lenders, but that only counts as one inquiry to your credit (here) as long as they are all done within 45 days.

Some of the small dealership do "in house" financing. This means that you don't need a credit score, but you don't get regular payments either. Instead, you pay $200-$300, every two weeks (every paycheck), for about one year to pay it off.

GAP Insurance:

For those who don't know, Guaranteed Asset Protection (GAP) Insurance can be very useful. It may go by other names, but look for this general description. Progressive Insurance calls it Loan/Lease Payoff.

Insurance Dilemma: Sometimes, after an accident where the vehicle is declared a total loss, your Full Coverage Insurance will pay what the car is worth, but not what you owe. If your car is worth $14,000, they pay that. But If you owe$16,000; they still only pay $14,000. That means you will STILL owe $2,000 which you must continue to pay after the car is already totaled.

Oh, and don't forget your $1,000 deductible, which they subtract from the total payout. Now they only pay $13,000, which means you are left with a bill for $3,000.

If you have a lot of cash on hand to account for this, and you can just pay that final $3,000, and be done with it. Or, you can keep paying the monthly payment (most of the time) until the final amount is paid off. Some lenders will allow you to do an "Insurance Deficiency Refinance", to lower your payment on that final left over amount.

If you do not pay the left over, this will become a charge off on your credit, and your credit is ruined.

I started to purchase GAP Insurance through USAA, but then I found out that I can add this to my Full Coverage through Progressive for $16/Year. (about a $1+ per month), and I'll cancel it when my loan is lower than my value.

I hope that helps!

Life In Fort Worth By Darrell Wolfe

- New to the blog? Start HERE

- Click HERE to Subscribe by email.

What is YOUR favorite thing about Texas? Comment Below!

No comments:

Post a Comment

Keep it Clean and Fun. Please share your thoughts below.